5 min read

Collecting Parking Fines Sooner Can Boost Revenue and Mitigate Risk

Matt Darst

Apr 16, 2025 10:27:05 AM

Matt Darst

Apr 16, 2025 10:27:05 AM

Parking ticket collections can be a challenging process, with city officials often struggling to decide when to act. Many hesitate to initiate early collection efforts, fearing that doing so might increase collection rates but ultimately reduce overall revenue. However, collecting parking ticket debt sooner, rather than later, can lead to significant financial benefits. Cities should factor the time value of money (TVM), the risks posed by economic downturns, and other factors into their collection strategies.

Time Value of Money (TVM): The Dollar Today vs. the Dollar Tomorrow

The core principle of the time value of money (TVM) is that a dollar today is worth more than a dollar tomorrow. Why? Because money collected today can be put to work—invested, used for immediate needs, or saved to generate returns. Money collected later doesn’t have the same purchasing power.

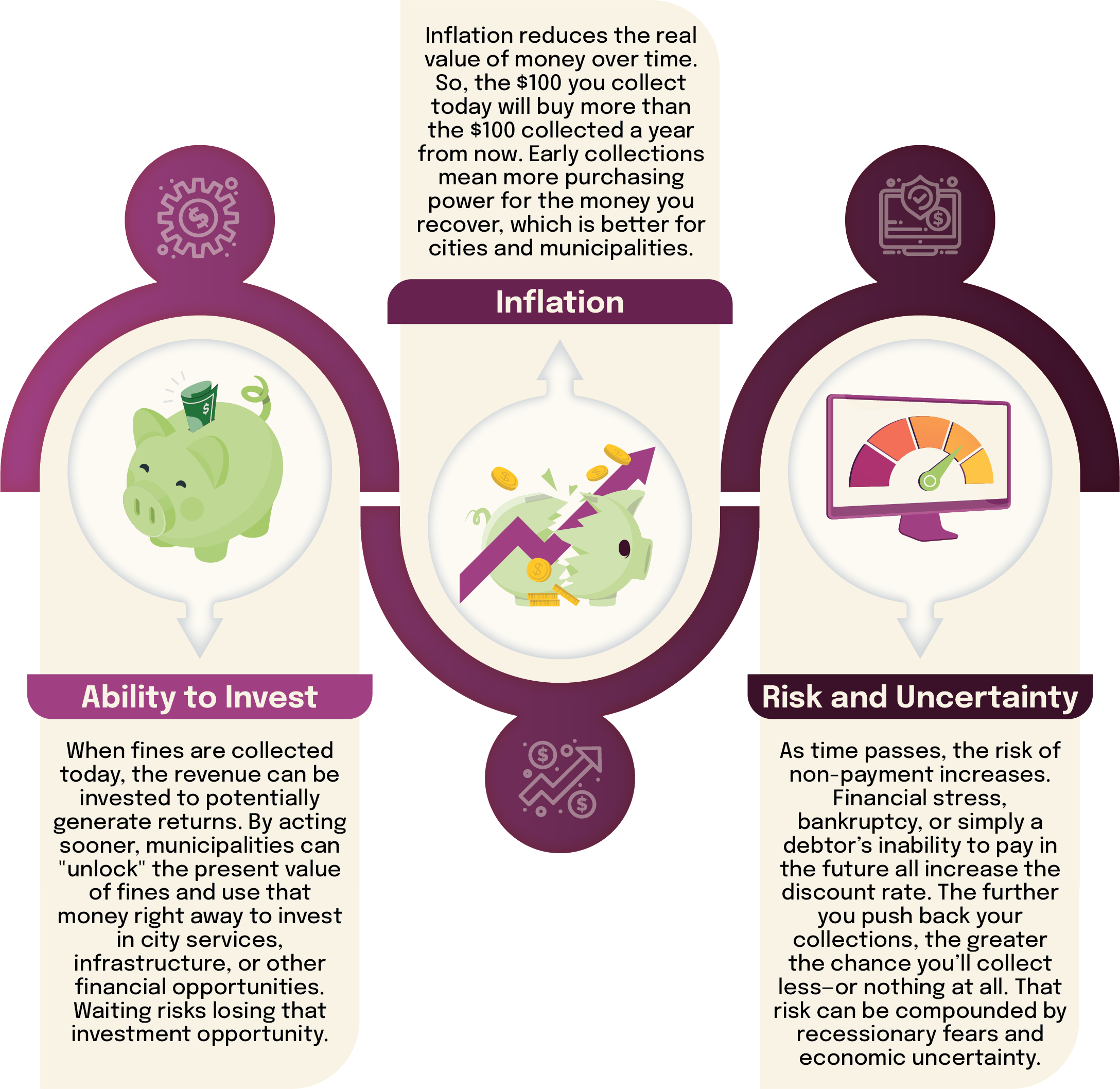

This idea is captured by what's called the discount rate, which helps us understand the "cost" of waiting for money. The discount rate factors in inflation, interest rates, risk, and the opportunity to invest. Simply put, the higher the discount rate, the less a future payment is worth today.

In addition to loans and investments, TVM applies to parking tickets. The longer you wait to collect fines, the less valuable those fines become. Tomorrow’s collections do little to impact city budgets today, and delays run the risk of inflation and economic factors eroding value.

Understanding Discount Rate

As the discount rate increases, the value of a dollar tomorrow shrinks. A few factors play a role in establishing the discount rate:

Recessionary Risks and Economic Uncertainty

During uncertain economic times, the risk of non-payment increases. People lose jobs, businesses struggle, and consumers tighten their belts during economic downturns. As this happens, it becomes harder for people to pay their parking fines.

By delaying collections, municipalities are essentially rolling the dice, hoping that the debtor's financial situation will improve. In the meantime, that debt may never get paid. By acting sooner, cities can lock in revenue before those external economic factors start to play a role, reducing the chance of default or partial payment.

Likelihood of Payment Decreases Over Time

People are more likely to pay fines early when they’re fresh in their minds. Waiting too long to pursue collections means debtors might start ignoring or procrastinating on payment. Or they may move. Or pass away. Or file bankruptcy. It’s harder to recover debt once someone forgets or no longer has the financial flexibility to pay.

Contingency Fees and Operational Costs

Collecting parking tickets, however, costs money. Mailing notices and hiring collection agencies is not cheap. Consequently, cities sometimes defer collections in hopes of delaying costs, taking a passive “wait and see” approach in hopes payments will trickle in naturally.

While it’s true that earlier collection efforts and quicker recovery might mean less net revenue, it’s a trade-off that will likely pay off. Delaying collections often means more resources are spent on tracking down debtors, issuing additional notices, and pursuing legal action. The longer the debt goes unpaid, the more expensive and resource-intensive the collection process becomes. Early collections streamline the process, making it more cost-effective, even if the fee is lower.

Understanding the Impact of Time on Parking Ticket Collections: A Discounted Example

To better understand how the time value of money works in the context of parking ticket collections, let’s consider an example. Imagine a $100 outstanding parking ticket. The timing of when it is paid can significantly affect its value based on the following factors.

These risks equate to a modest 11% discount rate and determines the present value of future parking ticket fines. See the example in the table below. In Year 1, the fine is valued at its full amount of $100. However, as time passes, the value of the fine declines due to the 11% discount rate. In Year 2, the fine is worth $90.09, in Year 3 it’s worth $81.16, and by Year 4, it drops to $73.03. This reduction in the value of the fine means that, over time, the money collected from fines will be worth less in real terms, which directly impacts the municipality's overall revenue.

|

YEAR |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

|

Discount Rate (11%) |

$100 |

$90.09 |

$81.16 |

$73.03 |

|

Collection Rate |

70% |

50% |

30% |

20% |

|

Revenue |

$70.00 |

$45.05 |

$24.35 |

$14.61 |

|

Cost to Collect |

$25.00 |

$25.00 |

$25.00 |

$25.00 |

|

Net Revenue |

$45.00 |

$20.05 |

($0.65) |

($10.39) |

|

Net Compared to Collection in Year 1 |

NA |

($24.95) |

($45.65) |

($55.39) |

The collection rate in the table reflects the percentage of fines that the municipality can successfully collect. In Year 1, the collection rate is relatively high at 70%, which leads to a significant amount of revenue being collected. However, as time progresses, the collection rate drops dramatically: to 50% in Year 2, 30% in Year 3, and only 20% in Year 4. This steady decline in the collection rate highlights the increased difficulty of collecting outstanding fines as time passes, further decreasing the overall revenue.

Revenue is directly influenced by both the discount rate and the collection rate. In Year 1, with a 70% collection rate and the full value of the fine at $100, the revenue generated is $70.00. However, in Year 2, with the fine reduced to $90.09 and the collection rate dropping to 50%, the revenue collected falls to $45.05. By Year 3, the lower collection rate of 30% and the reduced fine value of $81.16 result in $24.35 in revenue. By Year 4, the revenue drops even further to $14.61, as the fine’s value and collection rate continue to decline. This steady reduction in revenue demonstrates how waiting to collect parking fines results in a significant loss over time.

We’ve assumed a 25% fee as the cost to collect a parking ticket by a collection agency or law firm. The cost to collect remains constant at $25.00 each year, as the city continues to incur the same collection expense each year, even as the revenue from collected fines decreases. As the collection rate declines, the cost to collect becomes a larger burden relative to the amount being collected, contributing to a decrease in net revenue.

The most telling figure in the chart is the net revenue, which reflects the revenue collected after subtracting the collection costs. In Year 1, the municipality’s net revenue is $45.00, the best outcome for the entire period. However, as time goes on, the net revenue declines sharply. In Year 2, net revenue drops to $20.05, a $24.96 decrease compared to Year 1. In Year 3, the net revenue becomes negative, at -$0.65, representing a $45.65 loss compared to Year 1. By Year 4, the net revenue is -$10.39, a $55.39 loss compared to Year 1. This negative net revenue highlights that waiting to collect the fine actually results in a loss for city budgets rather than a gain.

Passing on Collection Agency Fees to Motorists

As cities turn to collection agencies to recover unpaid parking fines, some municipalities may pass the costs of these collection efforts onto the motorists who have failed to pay their fines. This is often done by adding additional fees for services rendered by the agency, which can include everything from administrative charges to legal costs. While this approach may offset the costs of collecting debts, there exists the potential for unintended consequences. For one, these extra charges can create more financial strain on motorists who are already struggling to pay their original fines, potentially reducing the likelihood of payment and exacerbating the city's collection challenges. Additionally, as the total amount owed increases due to these fees, it may become even more difficult for cities to recover the original fine. Therefore, cities must carefully balance the need for efficient debt recovery with the potential negative impact that passing on collection fees may have on their overall collection strategy.

Conclusion: Early Collection is the Smarter Move

Collecting parking fines sooner rather than later isn't just about efficiency—it’s a strategic financial decision that maximizes the value of the debt. From leveraging the time value of money and understanding how the discount rate impacts future payments, to mitigating the risk of economic downturns, earlier collections allow cities to secure revenue before external factors erode its value.

By acting quickly, municipalities can also increase the likelihood of payment, reduce operational costs, and avoid collection challenges. While it may seem tempting to delay collection in hopes of higher future payments, the reality is that waiting too long often leads to lower recovery rates.

If you're looking for expert insights and data-driven strategies to optimize your parking fine collections, Trellint’s data scientists and collection strategists can help you navigate the complexities of debt recovery. Contact us today to learn how we can help you maximize revenue while minimizing risk.